Turnarounds. Sounds exciting, right?Turnarounds are very risky. So be careful with those companies. Not all the turnaround companies are successful. We must be very vigilant of any negative news. Jyoti is also going through the same period.

Let's see the industry first.

Industry Tailwinds

1. 5+lakh cr investment for transmission and distribution segment in domestic market by 2030

2. Annual avg investment globally in transmission and distribution sector expected to rise from $350 bn per annum to $550 bn per annum

3. India's power generation and transmission sectors expected to grow to $280 bn by FY30

4. The National Electricity Plan aims to increase the transmission network from 485000 ckt km in 2024 to 650000 ckt km by 2032

5. India's power consumption per capita is around 2519 kWh. To become a developed nation, this number must increase

6. India's power capacity to grow to 900 GW by 2032 from 452.69 GW in 2024

7. India's transmission sector expects to grow by 5 times with an investment outlay of 10 lakh cr by 2032 from 2530 GVA

Let's deep dive into the company. I would like to mention some points here.

1. There's been a management change in 2021. The new chairperson is Dr. Rajendra Prasad Singh, an ex of Power Grid, NTPC executive. The new CEO, Rajesh Kumar Singh is an ex-Adani executive. So I think, this connection may help the company in getting bulk orders. Due to this connection, Jyoti might get some huge orders later. It has already started to reflect on their order books.

2. The company is on hiring spree. It shows on their LinkedIn profile and in their income statement also. Naturally, there will be a dent in the profit.

3. Public capex is quite well on track though with a little slowdown due to various temporary events, private capex is about to pick up sooner rather than later.

4. A recent report by Nomura gives a very positive multidecadal outlook about India's power sector.

5. Company has reduced debt from 7400 cr in FY2021 to 1910 cr in FY24

6. In Dec 2023, the company alloted 6.07 cr convertible warrants at 13.20 rs/warrant and 1.34 cr equity shares at 13.20/share

7. In March 2024, company alloted 11.64 cr equity shares at 15/ share on a rights basis

8. Timeline of ESOS

13-06-2023 - ₹5

19-07-2023 - ₹5

17-10-2023 - ₹10

09-02-2023 - ₹18

29-05-2024 - ₹15

9. Since its management change, the company has been constantly raising money through various ways such warrants, rights, preferential, NCDs etc at various prices to repay its debt and working capital requirements

Previous debt resolution plan failed. But the recent attempt was successful

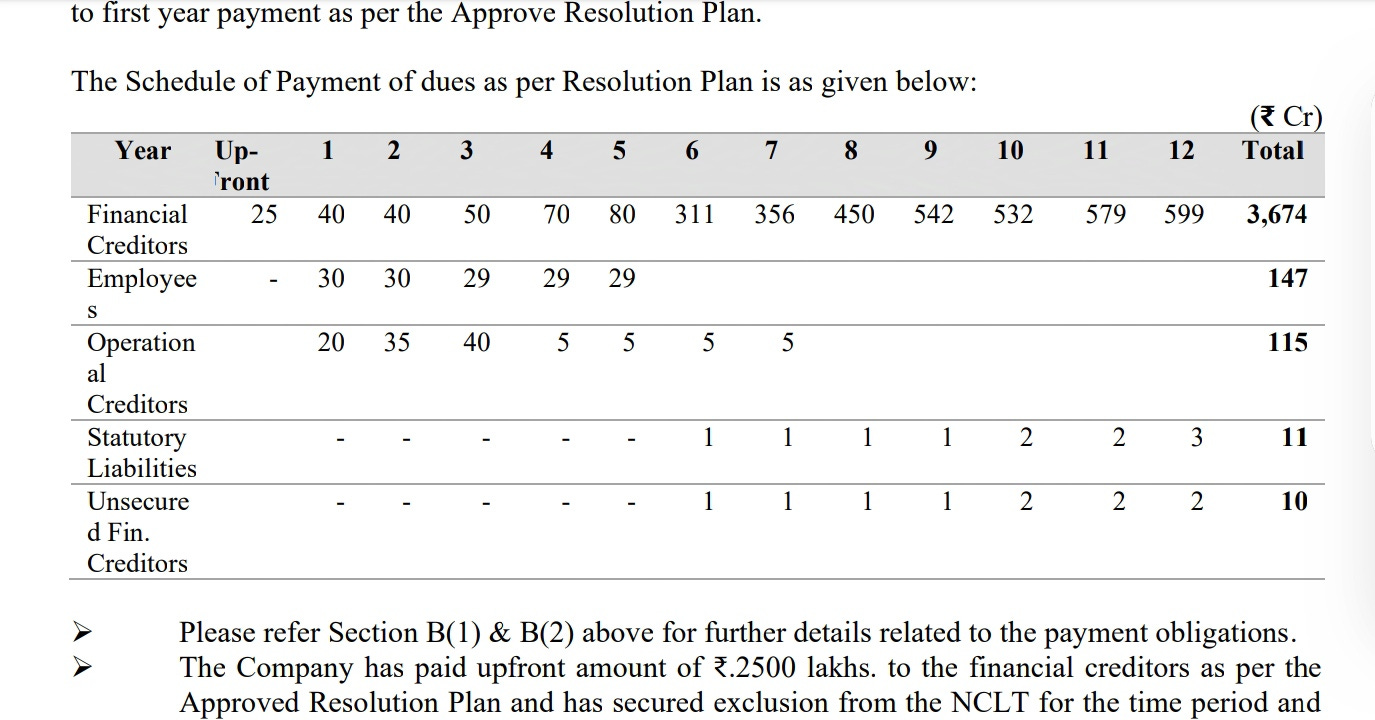

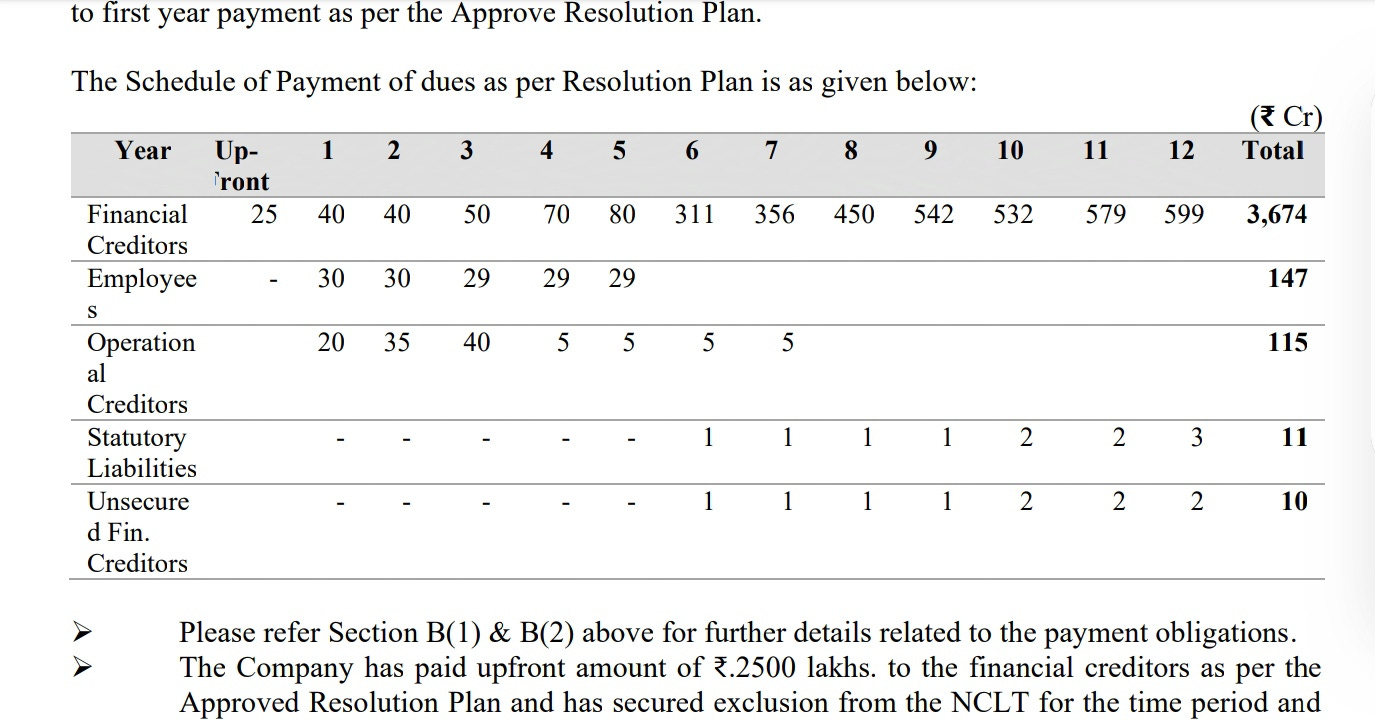

Also, according to the resolution plan, 3674 cr will be paid to its secured creditors over the period of next 12 years. Also other dues are there as well. How would they do it? Might be through raising funds, borrowing, or through using cash flows.

There's no analyst coverage. That might be a plus point. As soon as they start to come, this space will be crowded. No recent investor presentations. No recent credit reports or concalls. Only annual reports and a few press releases.

There were several reforms by the govt in the power sector over the past few years. It will continue as well. Now as the company is recovering from the brink of extinction, it might take some advantages of the previous reforms.

The company is bidding for 12500 cr worth of projects

Key Things to Track

The main issues with these companies is if the capex of the industry rolls on incrementally year on year, the companies in this such industry will get benefitted. They will get more orders year over year. As it is seen in their previous annual reports, the company delivered 25-40% growth in their topline and bottomline as well from 2005-06 to 2010-11. At one time, the company was a market darling. Then suddenly, positive trajectory changed. Revenue started to degrade. Industry capex slowed down. The company was facing tough times. Customers weren't clearing dues. There was debt restructuring process going on but it didn't succeed. Margin pressure, working capital issues, debt increment, cash crunch in the whole infra sector, rising finance cost and so many issues dragged down the whole industry. Also banks were not issuing new loans for such companies due to high NPAs in the whol banking sector. Power transmission and distribution sector was going through a difficult phase. SBI took the company to NCLT in 2017. The case went on till 2019. Then the current management came on board

Check their execution performance

Check if they are getting orders regularly

How they are funding their next projects

As the company is in a capital intensive sector, there would be cash flow issues at some point

It really takes time for a company to turnaround and start from scratch

Please don't blindly bet on the stock price. Over the years, they increased their equity rapidly. So, at its peak during 2008-09, if I calculate its market cap, it would be around 2500-3000 cr INR split adjusted (Split shares to ₹2 from ₹10 in 2006). Now, it is around 3000 cr.

If the company can't pay its regular installments loans then there would be hiccups in the stock price

There is still a good amount of debt. If the company could recover at least 50% of its receivables, then the current debt would be reduced enough.

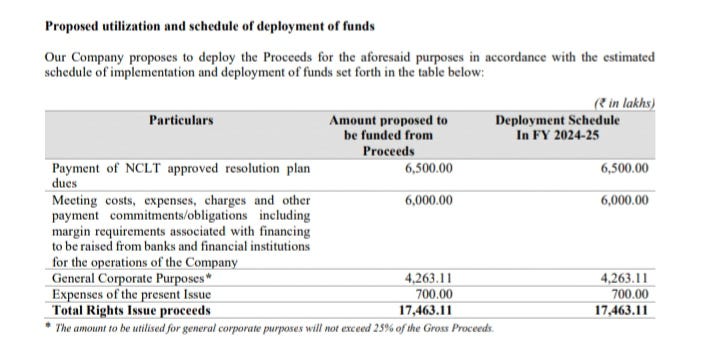

The company has recently raised 174.63 cr from several investors of which it is supposed to use

i. 65 cr for its financial creditors employee creditors, operational creditors and others

ii. 60 cr for meeting costs, expenses, charges, margin requirements associated with financing for the operation of the company

iii. 42.63 cr for general corporate purposes

iv. 7 cr for the next issue expenses

As per the resolution plan, the company will be paying 3674 cr to its financial creditors over the next 12 years, 147 cr to its employees over the next 5 years, 115 cr to its operational creditors over the next 7 years, 11 cr and 10 cr for statutory liabilities and its unsecured financial creditors over the 7 years period starting from 6th year

Now, over the next 5 years, the company has to pay around 90-120 cr each year. So, the first year is 90 cr (40 cr to financial creditors, 30 cr to employees, and 20 cr to operational creditors). 25 cr to financial creditors is already paid. Only 65 cr is needed for this year which is already raised through rights. One year, I mean FY25 is atleast no worry. Next year, to repay all its debt, the company either has to raise funds or deliver superb numbers so that it can repay around 100 cr debt from its profit or there will be danger.

Conclusion

Valuation wise, definitely it's expensive. But we shouldn't see in that way. Though the company has some orders already which gives us visibility over the next 1-2 years, it has just started from scratch. So, it's on spending spree now. There will definitely be profit squeeze.

As soon as the company starts getting huge orders, any material changes will be reflected in their income statement. On the negative side, if they don't get orders or can't execute properly, then stock price will move downward.

There are several tailwinds for the whole industry. So keep tracking their orders, debt repayment and execution capacity on regular basis.

Thanks

Rabi

Disclaimer: I'm not SEBI registered. This content is for educational purposes. Do your own diligence.