Business Analysis 8: Avro India Ltd

As soon as the guidance comes, the stock becomes double or triple within 4-5 months. But does that mean every stock can do the same thing?

As soon as the guidance comes, the stock becomes double or triple within 4-5 months. But does that mean every stock can do the same thing? Are you sure you're really picking a diamond from the dust?

In case of Avro India, we will try to dig deeper into the business. In Dec 2024, they uploaded their Q2 and H1 presentation. Press release on 16th November 2024 seems to be extremely exciting.

As you dig deeper, this excitement stimulates us do something wrong. You might be right but digging deeper into the business raises too many questions in our minds. We must remember that stock price doesn't always follow earnings only. It can be impacted by various things.

Let's start with Avro India. It's a very simple business; easy to understand. They make plastic furniture from plastic wastage. They recently started their plastic recycling unit in 2022 making the company with backward integrated facilities.

So, rather than being a plastic furniture manufacturer, it is making itself a recycling company as well. Recycling segment has opened the door for new business opportunities in future.

They target to achieve 4x growth in the top and bottom line in the next 3-4 years as per their press release. Avro is the first company to provide 3 years of guarantee on selected product range. Also, they have an advantageas compared to their peers because their products are 30-40% cheaper than the national/known brands.

Management plans to increase their 6000 MTPA recycling capacity to 12000 MTPA by FY25 and further increase by 5-7x in the next 3 years' time. They want to achieve the 50000 MTPA recycling capacity in a phased manner.

Also, their plastic furniture business will increase from 3 mn/year pieces to 5 mn/year pieces. As per their guidance, they want to achieve 300-350 cr topline with 17-18% PAT margin that means 51-63 cr, around 50% CAGR over the next 3 years on topline basis.

Pretty exciting, right? For a company which delivered 21% CAGR topline during FY21-24, it's extremely exciting. Please read on.

Though the industries they are playing in have no doubt promising future, it is the company how it plays along the way.

Indian plastic recycling market valued at $2.2 bn in 2024 and will touch $3.6 bn, growing at 10.76% CAGR (CSIRO report)

There is a lot of buzz around the recycling industry.

On the other hand, global plastic furniture market valued at $15.37 bn in 2023 and will touch $26.47 bn by 2032, growing at 6.23% CAGR.

So, the industries they are in have exciting prospects. Let's come to their revenue mix.

Furniture - 100 cr (FY25)

Projected to increase furniture - 180 cr + recycling - 150 cr (FY27)

Right now as of FY24, their sales mix is around 97.45% ftom offline and 2.55% from online.

Unit economy is an easy and a rational way to project future income.

Realization/ pieces

FY24 - ₹255

FY27 - ₹300

Production capacity

FY24 - 3 mn pieces

FY27 - 6 mn pieces

No of distributors

FY24 - 250

FY27 - 450

Recycling capacity

FY24 - 12000 MTPA

FY27 - 50000 MTPA

So far the unit economy is concerned, they will earn around 180 cr (300*6mn) from furniture segment by FY27 and the rest will come from the recycling business.

They are spending huge on advertisement. All capex will be funded through internal accruals. Frequent preferential issues make investors so exciting. Recently, they raised money through preferential from promoters and non-promoters in Dec 2024 at ₹185.50. Before that, they did a preferential in August also at ₹127.25 to promoters and Non-promoters.

As per their guidance, if the company really achieves these numbers, then the PE ratio right now is around 3-4 as of CMP - 239 cr (market cap). Looks too cheaper and a great opportunity to buy. Would you buy immediately? Wait... There's more to check.

I'll point out some risks that might demotivate you from buying. But it is your call. I'm not SEBI registered. This is just for educational purposes only. I'm not an adviser.

Risks

1. They are targeting 300-350 cr revenue, based on what? Recycling business that hasn't reflected on their topline yet? The recycling business was started in 2022 but the revenue is coming only from the furniture segment.

2. Typing errors especially in the chairman's message section in their FY24 annual report.

3. H1 FY25 has already been laggard. I don't know how they can achieve their huge target. Maybe H1 is slow growth.

4. If they are targeting 4x growth in the topline and bottom line as per their press release, how can the top and bottom behave in a similar fashion? It's confusing. And how the target of 17-18% PAT margin deliver only 4x bottom line. It must be higher, 13-15x as per their investor presentation. Maybe within two weeks, everything changed.

5. The company made last conference call in Aug 2023, till then there's no conference call or even investor presentation except Dec 2024, the recent one.

6. Delay in filling disclosure of related party transactions for the half year March 2023 and paid a meagre amount of fine subsequently.

7. Son, Sahil Aggarwal with an experience of more than 14 years and father, Sushil Kumar Aggarwal with an experience of more than 30 years drew similar remuneration in FY24. That means experience doesn't matter much for the company.

8. Being a promoter, Mrs Anita Aggarwal is taking sitting fees (FY24) even if it is smaller than the other non executive and independent directors.

9. They are the top 3 plastic furniture manufacturer as per their investor presentation but as per their press release, they are the top 5. That means within two weeks everything changed so dramatically.

Let's look at some screenshots from Aug 2023 concall.

We haven't seen such exponential results yet.

It seems like they didn't have a concrete plan at that time. Yet they did conference call. It is not expected from a 22-year company's chairman with experience of more than 30 years.

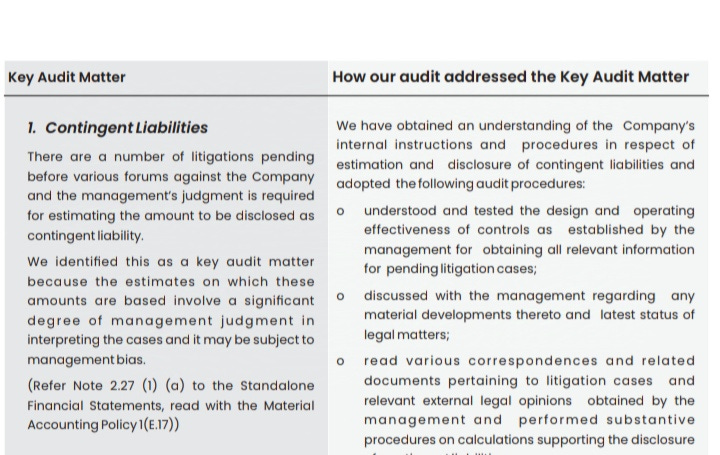

This is as per the independent auditor’s report.

All these raise doubts in an investor's mind. It's really very confusing how they will achieve such target. Yet the stock price is running like there's no barrier. Maybe I'm missing something or I'm wrong.

My Take - If I really want to invest in such companies, I will track their earnings first going forward. If the results are good, I will start investing but in a staggered way. If not, then I'll definitely stay away even if it runs madly from here on.

Thanks for reading

Take care

Rabi

Disclaimer: I'm not SEBI registered. This content is for educational purposes only. Do your own diligence.